RBI Monetary Policy: The MPC has kept rates consistent at a time inflation is showing a facilitating pattern and recuperation is occurring on the ground

The monetary policy committee (MPC) on October 8 kept the key loaning rate, the repo rate, unaltered at 4% and held the financial position as 'accommodative'. An accommodative position alludes to the rate-setting board's eagerness to either cut rates or stay on hold. Repo is the rate at which the national bank loans transient assets to banks.

This is the eighth back-to-back time the MPC keeping a business as usual in rates. The rate activity is on the normal lines as most market analysts surveyed by Moneycontrol had anticipated a business as usual in rates considering the current development swelling situation.

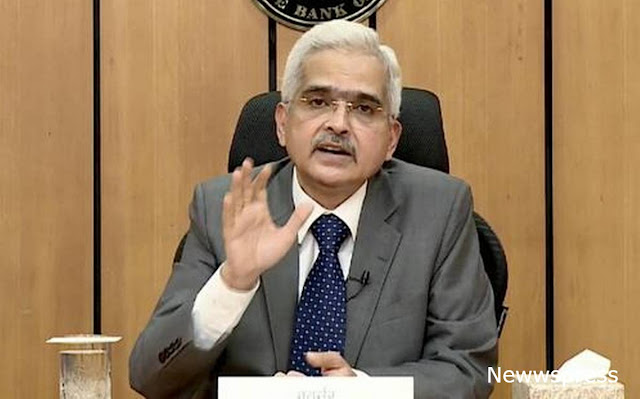

"The RBI's Monetary Policy Committee has chosen to keep up with the Repo Rate at 4% in the October strategy. We additionally hold the 'accommodative' position and will guarantee that swelling stays inside the target range. The arrangement rate choice was consistent, position choice was 5:1," said Governor Das.

The Governor likewise declared that Marginal Standing Facility (MSF) has been unaltered at 4.25 percent. He added that the July-September CPI swelling was "lower than expected".

"We are seeing a few indications of recovery in venture action. Further, with repressed interest, the happy season should help metropolitan interest".

The RBI has additionally kept up with the FY22 GDP development focus at 9.5 percent. For Q1FY23, the national bank has a GDP development focus of 17.1 percent.

Das said the national bank sees Q2FY22 GDP development at 7.9 percent contrasted with 7.3 percent before; Q3FY22 GDP development at 6.8 percent against 6.3 percent prior and held the GDP development at 6.1 percent for Q4FY22.

"High recurrence markers recommend monetary movement has acquired energy. Center expansion stays tacky. July-September Consumer value Index (CPI) expansion was lower than expected. India in a greatly improved spot today than at the hour of the last MPC meeting," the Governor said

"Development motivations are reinforcing, expansion direction more ideal than anticipated. Repressed interest, celebration season should support metropolitan interest. Recuperation sought after accumulated speed in Aug-Sep. Get in import of cap merchandise highlight some recuperation in movement," he noted.

On the expansion front, the national bank has brought down its FY22 CPI Inflation focus to 5.3 percent from the prior 5.7 percent. It additionally saw July-September CPI swelling at 5.1 percent contrasted with the 5.9 before. The October-December CPI Inflation is assessed at 4.5 percent contrasted with the 5.3 percent prior.

Significantly, the RBI sounded hopeful on the development recuperation in the Indian economy. On October 5, rating office Moody's climbed India's sovereign credit score viewpoint to stable from negative, referring to an improvement in the monetary area and quicker than-anticipated financial recuperation across areas.

Thanks for being here, for more updates stay connected with